Exploring Hybrid Finance: 50,000% APY and Passive Income Strategies

Written on

Chapter 1: Understanding Rebase Tokens

Rebase tokens represent a unique category in cryptocurrency, characterized by their ability to alter circulating supply in response to market price fluctuations. This adjustment occurs through a mechanism known as rebasing, where the supply is either increased or decreased algorithmically based on the token's current value.

Here’s a quick overview of how rebase tokens function, emphasizing their appeal in passive income generation.

Section 1.1: The Mechanics of Rebase

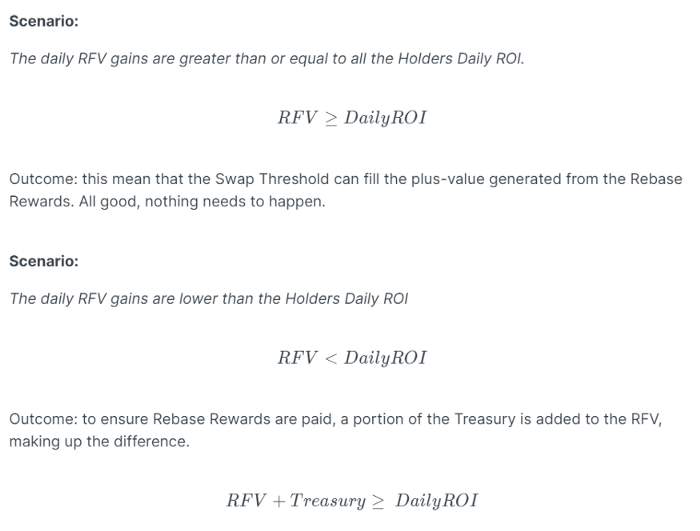

When a rebase event occurs, token holders benefit from the positive rebase formula. This mechanism allows them to accumulate more tokens without the usual complexities associated with traditional staking. The positive rebase is underpinned by a Risk-Free Value (RFV), secured through fees collected from token transactions.

Subsection 1.1.1: Risk-Free Value (RFV) Explained

The RFV operates as a dedicated wallet that collects funds to bolster and stabilize the liquidity pool. This feature is crucial during abrupt sell-offs that could otherwise deplete liquidity, ensuring that buying and selling of the token remains uninterrupted.

Section 1.2: Annual Percentage Yield (APY)

The APY quantifies the actual return on investment by factoring in the impact of compound interest on the principal tokens. As tokens are rebased, the compound interest builds up, enhancing overall returns.

Let’s begin with a brief introductory video:

Chapter 2: Introducing Hybrid Finance

Hybrid Finance is an innovative rebase token protocol set to launch on the Avalanche Blockchain. It combines two established revenue generation methods to achieve an astounding 50,000% APY.

The first video provides insights into the potential of TITANO in generating passive income with remarkable Annual Percentage Yields.

Section 2.1: Revenue Generation Mechanisms

Hybrid Finance utilizes transaction fees as its primary revenue stream. A 10% fee on purchases and a 15% fee on sales are directed towards the RFV, sustaining the rebase process effectively.

Section 2.2: Treasury Allocation Strategy

The treasury, comprising 30% of transaction fees, is divided into two main investment categories: low-risk (stable yield farming, liquidity pools, staking) and high-risk (seed round investments, venture capital). This dual approach supports a robust financial framework for the protocol.

Section 2.3: Security Measures

Hybrid Finance ensures security through KYC verification by the Obsidian Council and employs a multi-signature wallet with third-party oversight. Details about the audit will be disclosed in due course.

Disclaimer: The information provided here is for educational purposes only and should not be construed as financial advice. Always conduct thorough research before making investment decisions.