Navigating the Intersection of Crypto and Rising Interest Rates

Written on

Chapter 1: Understanding the Impact of Federal Reserve Actions

The Federal Reserve's decisions regarding interest rates can significantly influence the cryptocurrency landscape. As interest rates rise, cryptocurrencies can adapt and potentially thrive, presenting a unique opportunity for investors and businesses alike.

"Investing in cryptocurrencies during fluctuating interest rates can be a strategic move for those looking to diversify their portfolios."

Section 1.1: The Relationship Between Interest Rates and Crypto

When the Federal Reserve increases interest rates, it can create favorable conditions for cryptocurrencies. This shift may enhance liquidity and alter the flow of capital into various assets, including digital currencies.

Subsection 1.1.1: Key Factors in Money Flow

Understanding the dynamics of money flow is crucial. Several entities, including the Federal Reserve, US Treasury, large banks, and corporations, play pivotal roles in shaping liquidity and investment opportunities in the crypto space.

Section 1.2: Diverse Investment Avenues

Capital can be sourced from various channels, such as retirement funds (IRA, 401K), trust funds, and Wall Street investment firms, which often channel investments into startups and innovative technologies.

Chapter 2: The Future of Crypto in Capital Markets

As interest rates rise, traditional assets like real estate and collectibles may see price adjustments, while cryptocurrencies could present new avenues for investment.

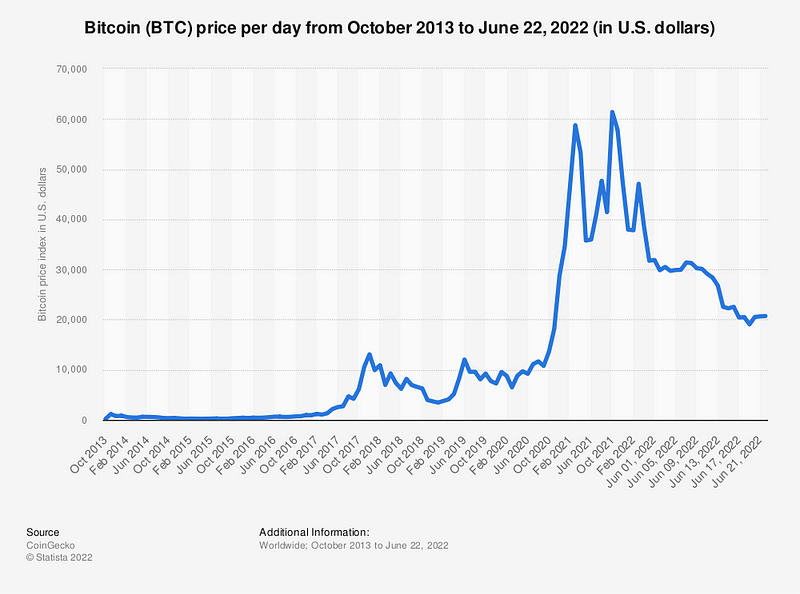

In the video "Fed Rate Cut WARNING! Prepare for Bitcoin Price Volatility," experts discuss potential market shifts and the implications for Bitcoin and other cryptocurrencies amidst interest rate changes.

Furthermore, crypto can emerge as a viable option for trading and lending, increasing its role in the financial ecosystem.

"Why $100k Bitcoin by End of the Year is Probable | EP 1078" explores the potential for Bitcoin to reach significant milestones as the market adapts to new financial realities.

The rise of cryptocurrencies could lead to innovative financial products, such as crypto-funded commodities and real estate investments, reshaping the investment landscape.

Conclusion: Embracing Change in the Financial Realm

As the economy evolves, businesses worldwide can leverage cryptocurrencies for transactions, thereby enhancing liquidity. The shift towards crypto in various sectors indicates a bright future for digital currencies in investment banking and venture capital.

Thank you for engaging with this content! Your feedback, subscriptions, and interactions are greatly appreciated.

For further reading, consider exploring topics like "Investing in Crypto," "Crypto for the Economy," and "Crypto Terminology."

Disclaimer: The author does not assume any liability for the views expressed. This content is intended for educational and informational purposes only and does not constitute legal, tax, accounting, or investment advice.